Teaching data science with the tidyverse

rstudio::conf(2022)

Designing the data science classroom

Mine Çetinkaya-Rundel

Introduction

Setting the scene

![]()

Assumption 1:

Teach authentic tools

![]()

Assumption 2:

Teach R as the authentic tool

Takeaway

The tidyverse provides an effective and efficient pathway for undergraduate students at all levels and majors to gain computational skills and thinking needed throughout the data science cycle.

Principles of the tidyverse

Tidyverse

- Meta R package that loads eight core packages when invoked and also bundles numerous other packages upon installation

- Tidyverse packages share a design philosophy, common grammar, and data structures

Setup

Data: Thousands of loans made through the Lending Club, a peer-to-peer lending platform available in the openintro package, with a few modifications.

library(tidyverse)

library(openintro)

loans <- loans_full_schema |>

mutate(

homeownership = str_to_title(homeownership),

bankruptcy = if_else(public_record_bankrupt >= 1, "Yes", "No")

) |>

filter(annual_income >= 10) |>

select(

loan_amount, homeownership, bankruptcy,

application_type, annual_income, interest_rate

)Start with a data frame

# A tibble: 9,976 × 6

loan_amount homeownership bankruptcy application_type annual_income interest_rate

<int> <chr> <chr> <fct> <dbl> <dbl>

1 28000 Mortgage No individual 90000 14.1

2 5000 Rent Yes individual 40000 12.6

3 2000 Rent No individual 40000 17.1

4 21600 Rent No individual 30000 6.72

5 23000 Rent No joint 35000 14.1

6 5000 Own No individual 34000 6.72

# … with 9,970 more rowsTidy data

- Each variable forms a column

- Each observation forms a row

- Each type of observational unit forms a table

Task: Calculate a summary statistic

Calculate the mean loan amount.

# A tibble: 9,976 × 6

loan_amount homeownership bankruptcy application_type annual_income interest_rate

<int> <chr> <chr> <fct> <dbl> <dbl>

1 28000 Mortgage No individual 90000 14.1

2 5000 Rent Yes individual 40000 12.6

3 2000 Rent No individual 40000 17.1

4 21600 Rent No individual 30000 6.72

5 23000 Rent No joint 35000 14.1

6 5000 Own No individual 34000 6.72

# … with 9,970 more rowsError in mean(loan_amount): object 'loan_amount' not foundTask: Calculate a summary statistic

How would you calculate the mean loan amount?

Add your answer to Discord.

Accessing a variable

Approach 1: With attach():

Not recommended. What if you had another data frame you’re working with concurrently called car_loans that also had a variable called loan_amount in it?

Accessing a variable

Approach 2: Using $:

Accessing a variable

Approach 4: The tidyverse approach:

# A tibble: 1 × 1

mean_loan_amount

<dbl>

1 16358.- More verbose

- But also more expressive and extensible

The tidyverse approach

Tidyverse functions take a

dataargument that allows them to localize computations inside the specified data frameDoes not muddy the concept of what is in the current environment: variables always accessed from within in a data frame without the use of an additional function (like

with()) or quotation marks, never as a vector

Teaching with the tidyverse

Your turn: Grouped summary

RStudio Cloud > “Module 2 - Tidyverse” > ex-2-1.qmd

Based on the applicants’ home ownership status, compute the number of applicants and the average loan amount. Display the results in descending order of number of applicants.

Compare answers with your neighbor and choose an approach you would teach in an intro course. Then, type your chosen answer on Discord along with some narrative about how you would approach teaching it describing how you would teach it.

| Homeownership | Number of applicants | Average loan amount |

|---|---|---|

| Mortgage | 4,778 | $18,132 |

| Rent | 3,848 | $14,396 |

| Own | 1,350 | $15,665 |

10:00

Break it down I

Based on the applicants’ home ownership status, computer the number of applicants and the average loan amount. Display the results in descending order of number of applicants.

# A tibble: 9,976 × 6

loan_amount homeownership bankruptcy application_type annual_income interest_rate

<int> <chr> <chr> <fct> <dbl> <dbl>

1 28000 Mortgage No individual 90000 14.1

2 5000 Rent Yes individual 40000 12.6

3 2000 Rent No individual 40000 17.1

4 21600 Rent No individual 30000 6.72

5 23000 Rent No joint 35000 14.1

6 5000 Own No individual 34000 6.72

# … with 9,970 more rowsBreak it down II

Based on the applicants’ home ownership status, compute the number of applicants and the average loan amount. Display the results in descending order of number of applicants.

[input] data frame

# A tibble: 9,976 × 6

# Groups: homeownership [3]

loan_amount homeownership bankruptcy application_type annual_income interest_rate

<int> <chr> <chr> <fct> <dbl> <dbl>

1 28000 Mortgage No individual 90000 14.1

2 5000 Rent Yes individual 40000 12.6

3 2000 Rent No individual 40000 17.1

4 21600 Rent No individual 30000 6.72

5 23000 Rent No joint 35000 14.1

6 5000 Own No individual 34000 6.72

# … with 9,970 more rowsdata frame [output]

Break it down III

Based on the applicants’ home ownership status, compute the number of applicants and the average loan amount. Display the results in descending order of number of applicants.

Break it down IV

Based on the applicants’ home ownership status, compute the number of applicants and the average loan amount. Display the results in descending order of number of applicants.

Break it down V

Based on the applicants’ home ownership status, compute the average loan amount and the number of applicants. Display the results in descending order of number of applicants.

Putting it back together

[input] data frame

loans |>

group_by(homeownership) |>

summarize(

n_applicants = n(),

avg_loan_amount = mean(loan_amount)

) |>

arrange(desc(n_applicants))# A tibble: 3 × 3

homeownership n_applicants avg_loan_amount

<chr> <int> <dbl>

1 Mortgage 4778 18132.

2 Rent 3848 14396.

3 Own 1350 15665.[output] data frame

Grouped summary with aggregate()

Grouped summary with aggregate()

Grouped summary with aggregate()

- Good: Inputs and outputs are data frames

- Not so good: Need to introduce

formula syntax

passing functions as arguments

merging datasets

square bracket notation for accessing rows

Grouped summary with tapply()

Grouped summary with tapply()

Grouped summary with tapply()

Not so good:

- passing functions as arguments

- distinguishing between the various

apply()functions - ending up with a new data structure (

array) - relegating a data column to rownames

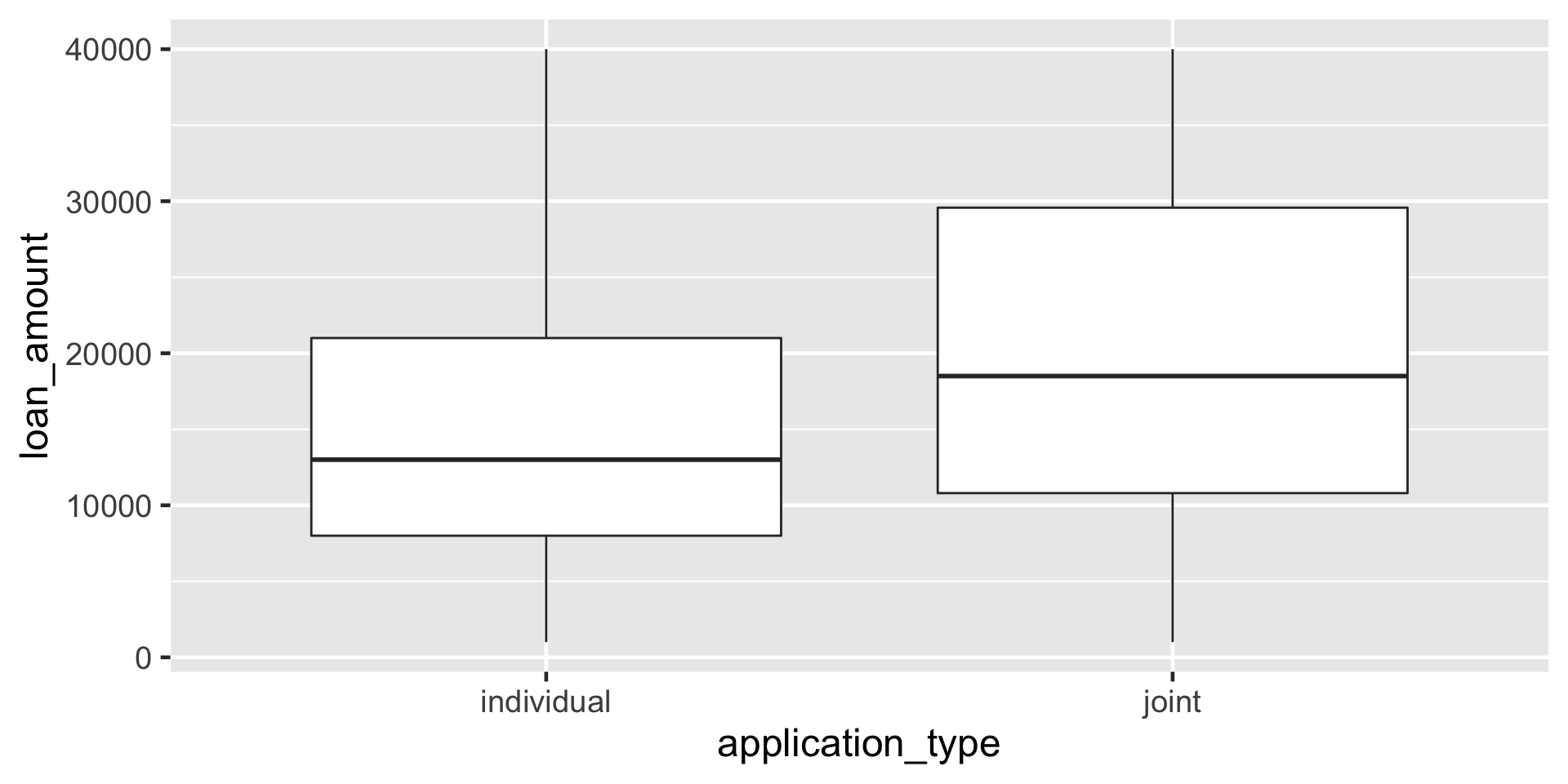

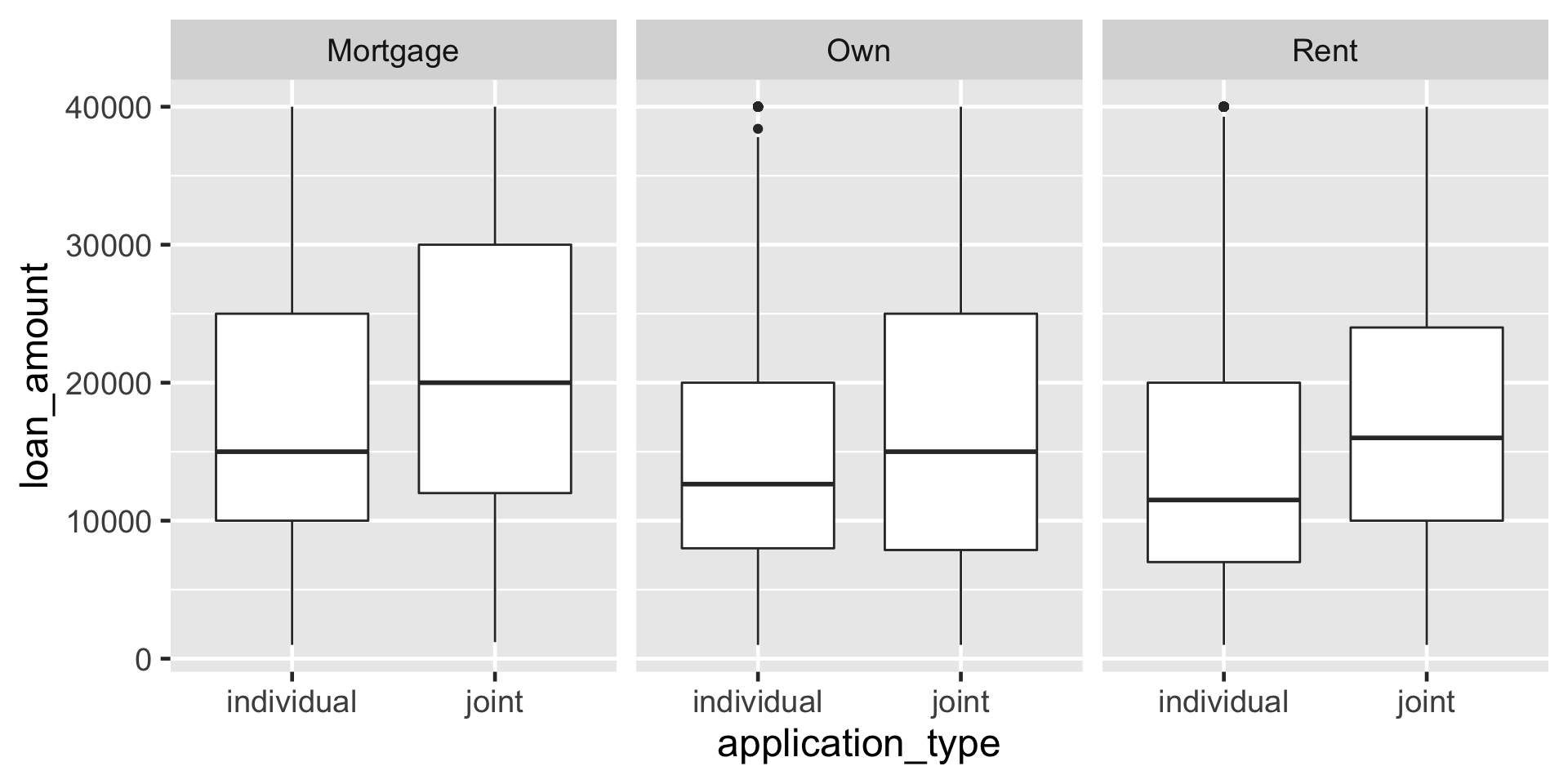

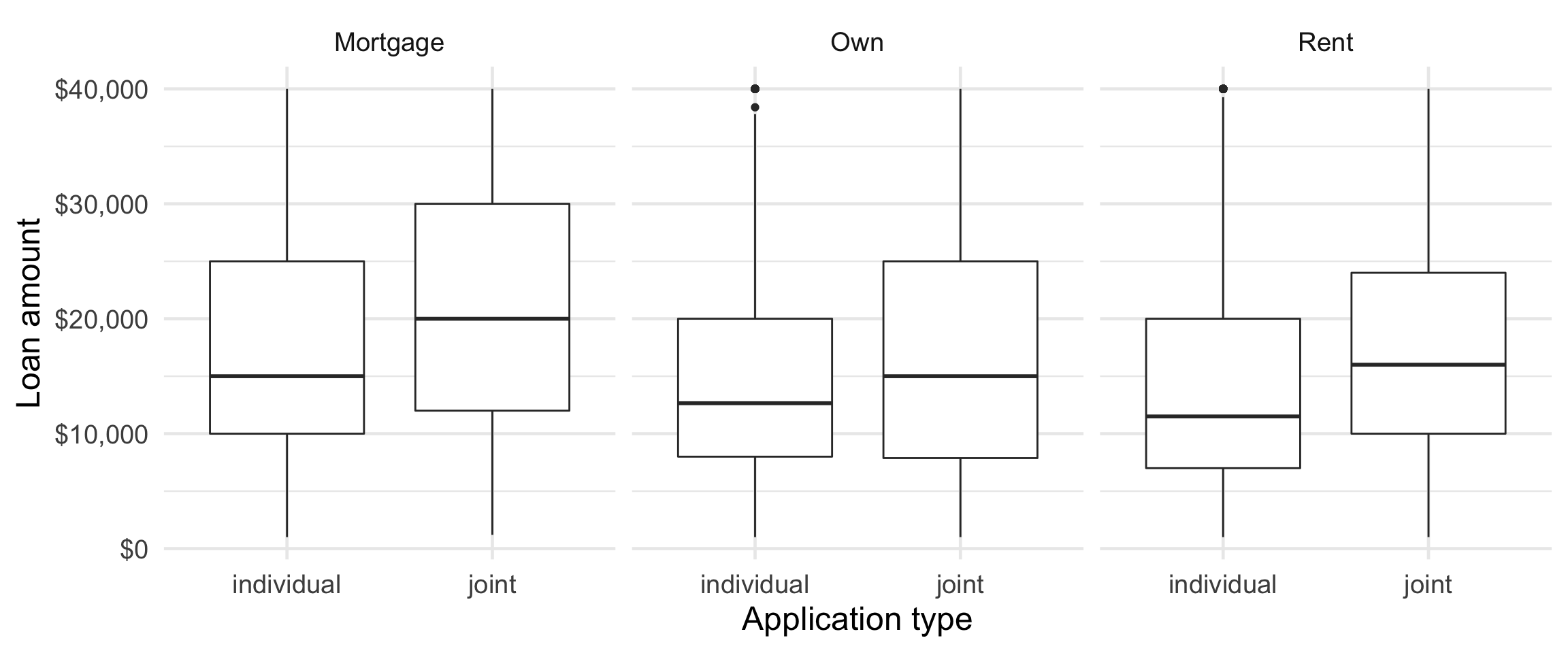

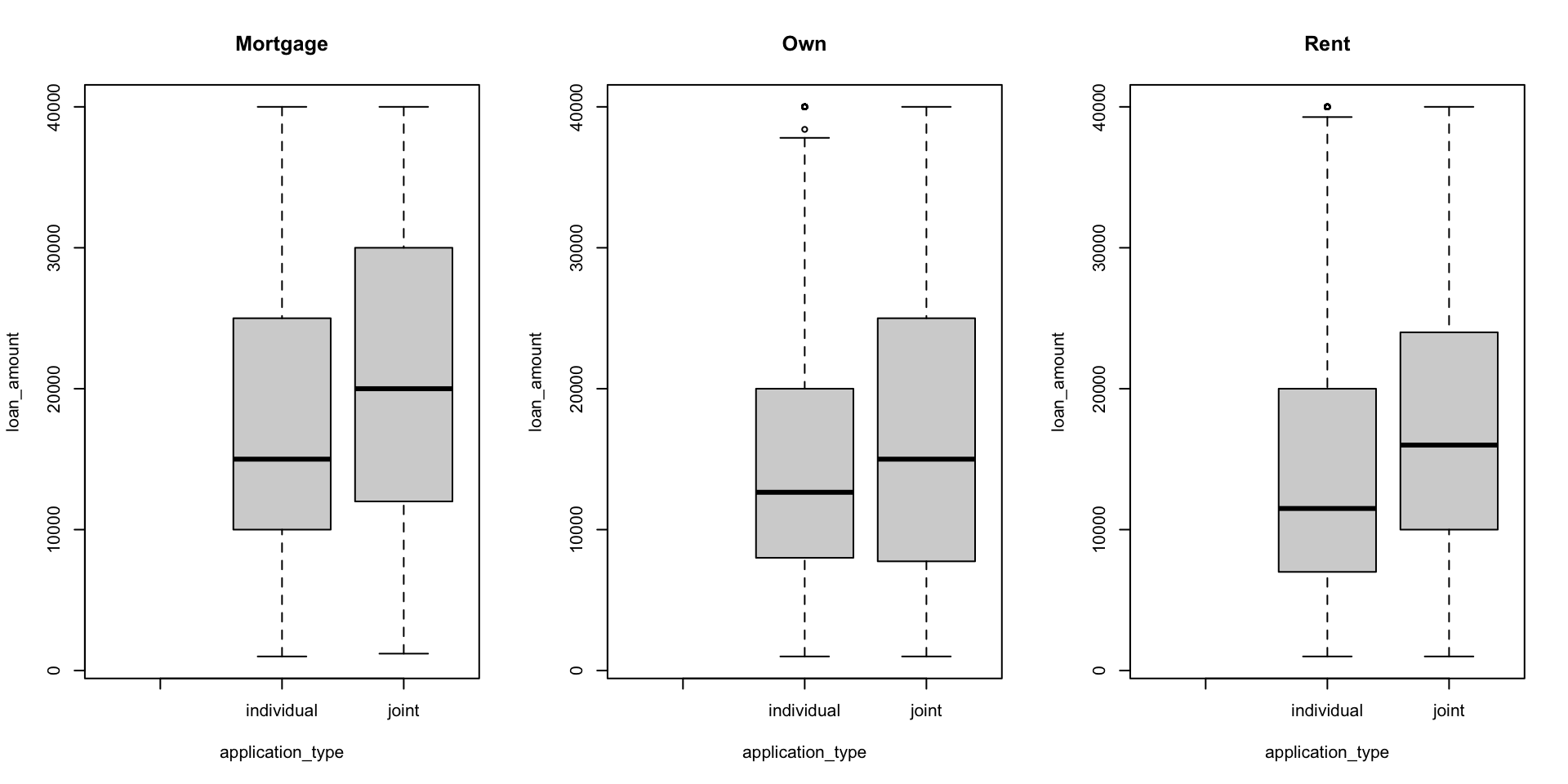

Your turn: Data visualization

RStudio Cloud > “Module 2 - Tidyverse” > ex-2-2.qmd

Using the loans data, create side-by-side box plots that shows the relationship between loan amount and application type, faceted by homeownership.

Compare answers with your neighbor and choose an approach you would teach in an intro course. Then, type your chosen answer and some narrative about how you would approach teaching it describing how you would teach it.

See next style for desired output.

10:00

Desired output

Break it down I

Break it down II

Break it down III

Break it down IV

Break it down IV

Plotting with ggplot()

- Each layer produces a valid plot

- Faceting by a third variable takes only one new function

Plotting with boxplot()

Plotting with boxplot()

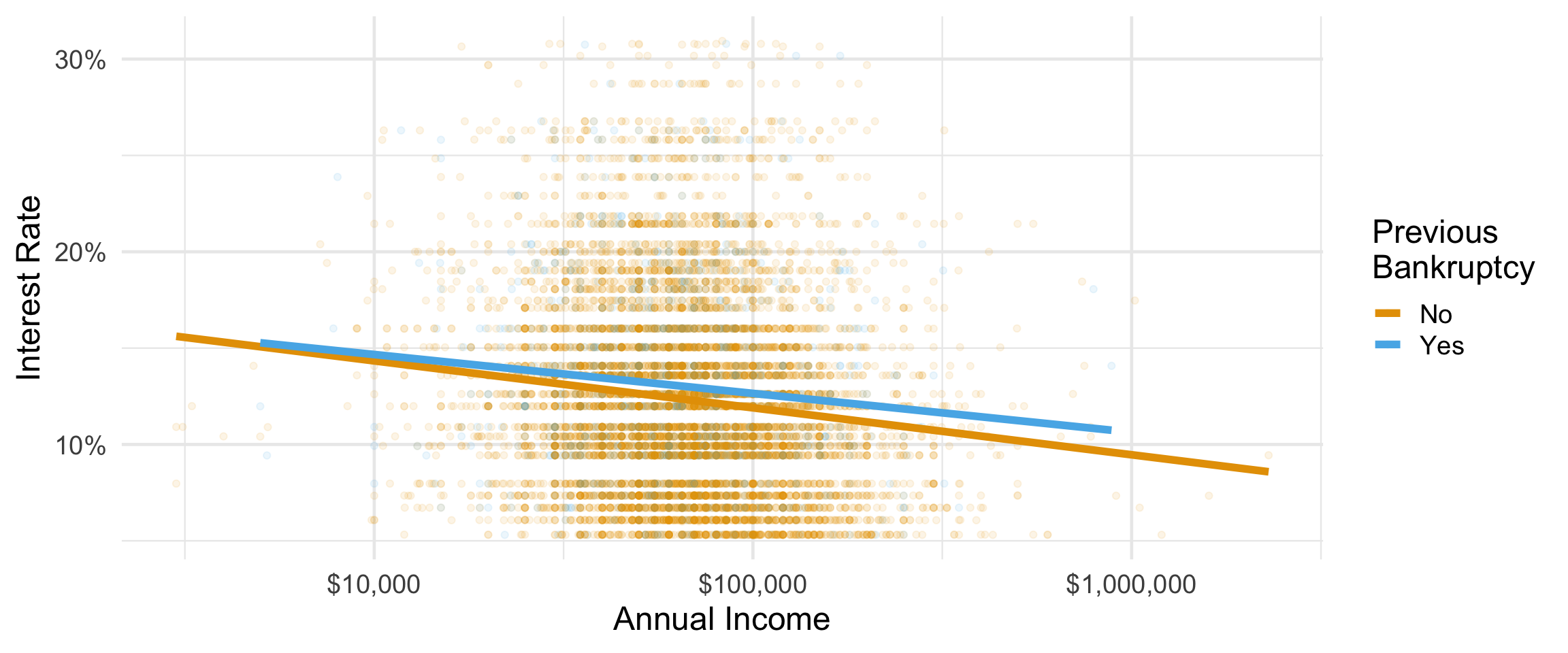

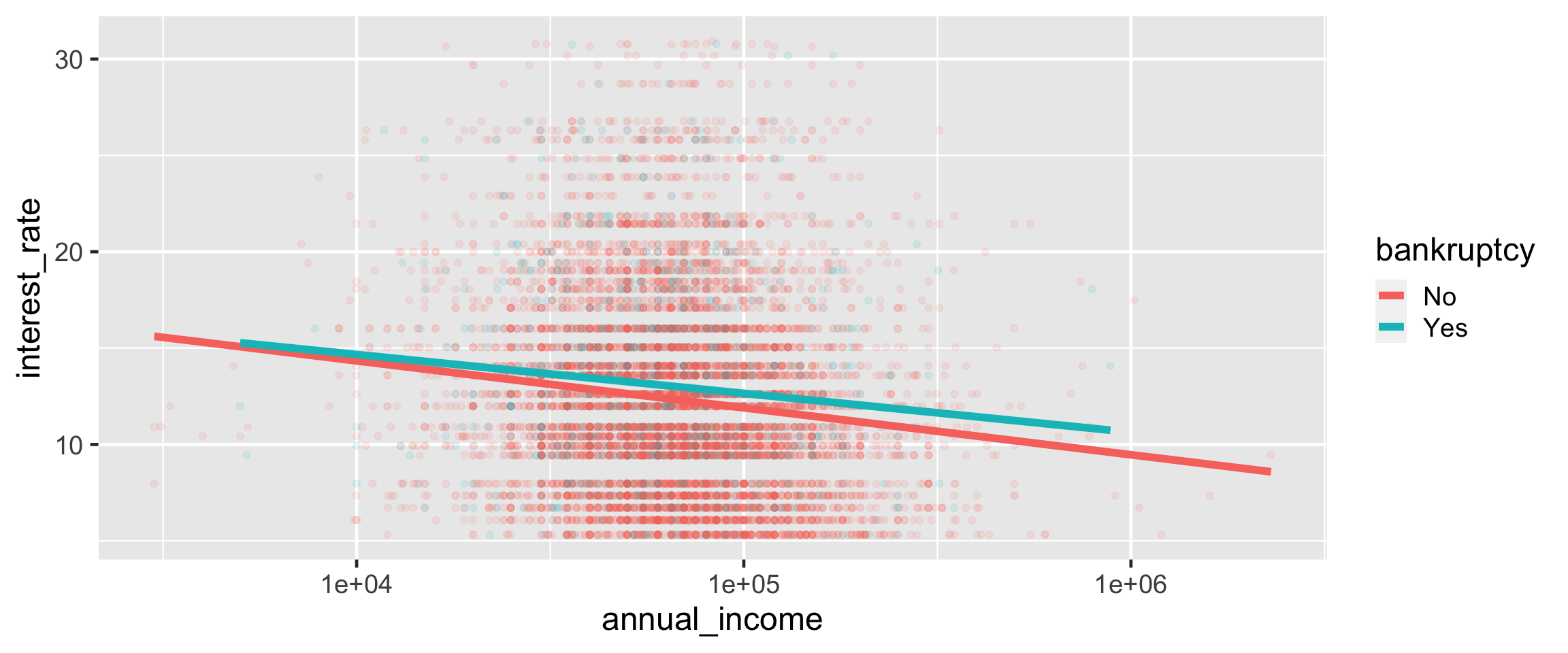

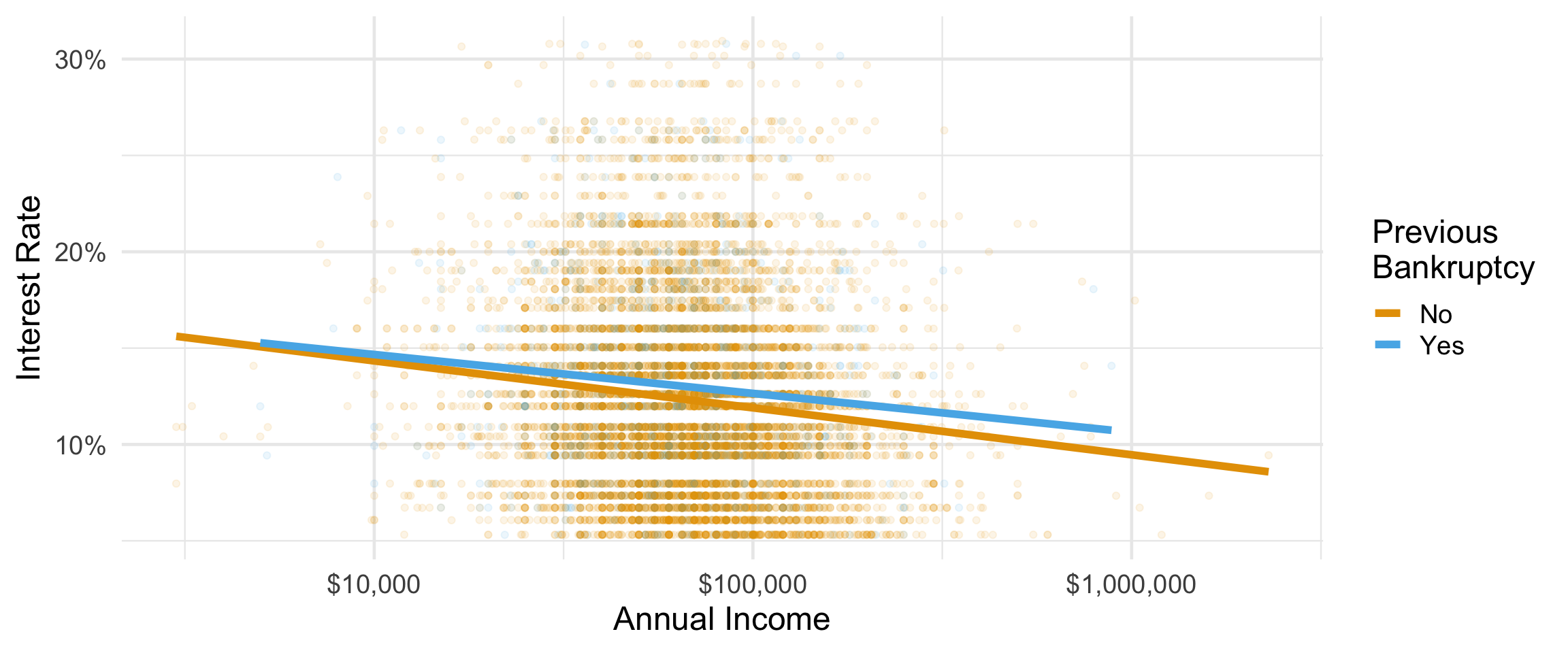

Visualizing a different relationship

Visualize the relationship between interest rate and annual income, conditioned on whether the applicant had a bankruptcy.

Plotting with ggplot()

Further customizing ggplot()

ggplot(loans,

aes(y = interest_rate, x = annual_income,

color = bankruptcy)) +

geom_point(alpha = 0.1) +

geom_smooth(method = "lm", size = 2, se = FALSE) +

scale_x_log10(labels = scales::label_dollar()) +

scale_y_continuous(labels = scales::label_percent(scale = 1)) +

scale_color_OkabeIto() +

labs(x = "Annual Income", y = "Interest Rate",

color = "Previous\nBankruptcy") +

theme_minimal(base_size = 18)

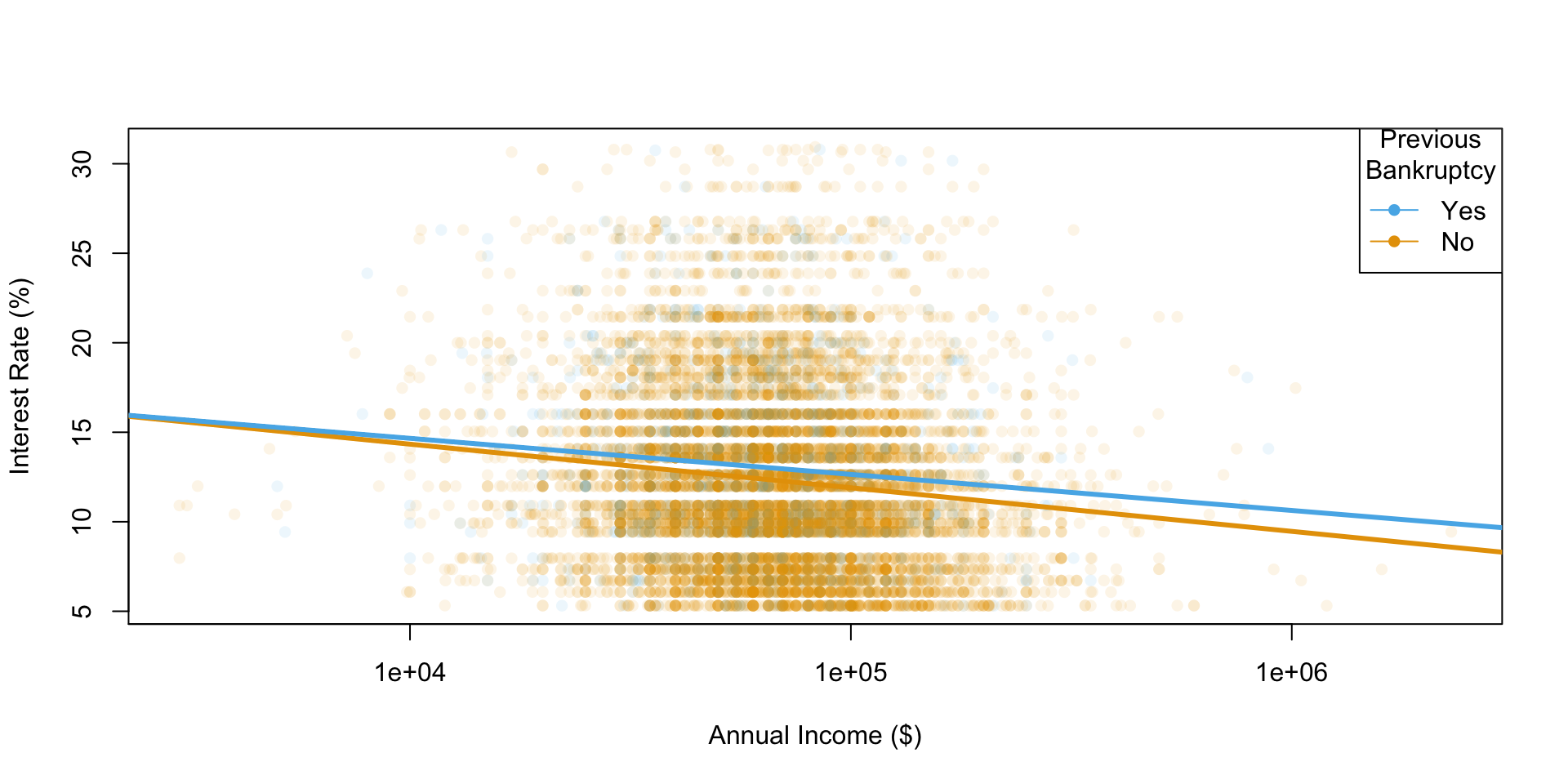

Plotting with plot()

# From the OkabeIto palette

cols = c(No = "#e6a003", Yes = "#57b4e9")

plot(

loans$annual_income,

loans$interest_rate,

pch = 16,

col = adjustcolor(cols[loans$bankruptcy], alpha.f = 0.1),

log = "x",

xlab = "Annual Income ($)",

ylab = "Interest Rate (%)",

xaxp = c(1000, 10000000, 1)

)

lm_b_no = lm(

interest_rate ~ log10(annual_income),

data = loans[loans$bankruptcy == "No",]

)

lm_b_yes = lm(

interest_rate ~ log10(annual_income),

data = loans[loans$bankruptcy == "Yes",]

)

abline(lm_b_no, col = cols["No"], lwd = 3)

abline(lm_b_yes, col = cols["Yes"], lwd = 3)

legend(

"topright",

legend = c("Yes", "No"),

title = "Previous\nBankruptcy",

col = cols[c("Yes", "No")],

pch = 16, lwd = 1

)Plotting with plot()

Beyond wrangling, summaries, visualizations

Modeling and inference with tidymodels:

A unified interface to modeling functions available in a large variety of packages

Sticking to the data frame in / data frame out paradigm

Guardrails for methodology

Next module is teaching with tidymodels!

Pedagogical strengths of the tidyverse

Consistency

No matter which approach or tool you use, you should strive to be consistent in the classroom whenever possible

Tidyverse offers consistency, something we believe to be of the utmost importance, allowing students to move knowledge about function arguments to their long-term memory

Teaching consistently

Challenge: Google and Stack Overflow can be less useful – demo problem solving

Counter-proposition: teach all (or multiple) syntaxes at once – trying to teach two (or more!) syntaxes at once will slow the pace of the course, introduce unnecessary syntactic confusion, and make it harder for students to complete their work.

“Disciplined in what we teach, liberal in what we accept”

Mixability

Mix with base R code or code from other packages

In fact, you can’t not mix with base R code!

Scalability

Adding a new variable to a visualization or a new summary statistic doesn’t require introducing a numerous functions, interfaces, and data structures

User-centered design

Interfaces designed with user experience (and learning) in mind

Continuous feedback collection and iterative improvements based on user experiences improve functions’ and packages’ usability (and learnability)

Readability

Interfaces that are designed to produce readable code

Community

The encouraging and inclusive tidyverse community is one of the benefits of the paradigm

Each package comes with a website, each of these websites are similarly laid out, and results of example code are displayed, and extensive vignettes describe how to use various functions from the package together

Shared syntax

Get SQL for free with dplyr verbs!

Final thoughts

Building a curriculum

Start with

library(tidyverse)Teach by learning goals, not packages

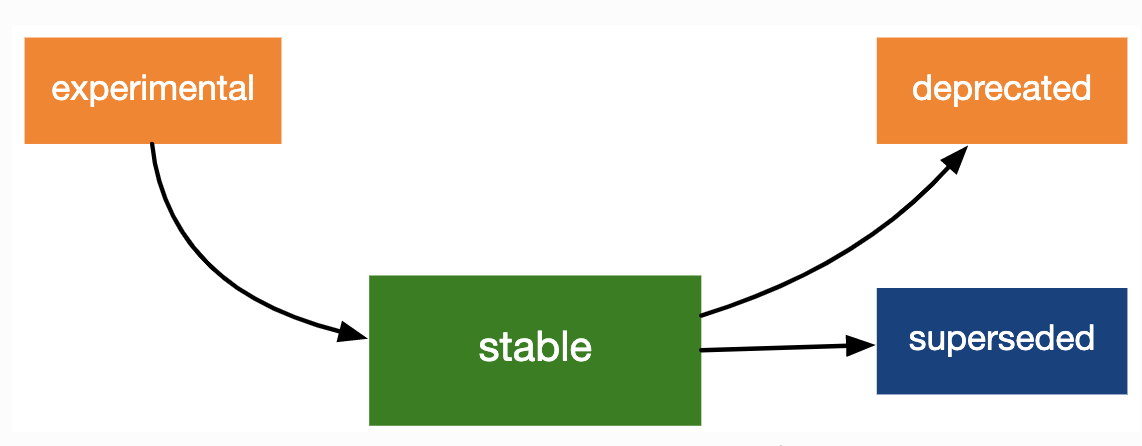

Keeping up with the tidyverse

Blog posts highlight updates, along with the reasoning behind them and worked examples

Lifecycle stages and badges

![]()

Coda

We are all converts to the tidyverse and have made a conscious choice to use it in our research and our teaching. We each learned R without the tidyverse and have all spent quite a few years teaching without it at a variety of levels from undergraduate introductory statistics courses to graduate statistical computing courses. This paper is a synthesis of the reasons supporting our tidyverse choice, along with benefits and challenges associated with teaching statistics with the tidyverse.

Discussion

Do you teach with the tidyverse?

- If yes, what are some highlights of your teaching experience and what are some challenges?

- If no, what is your approach and, if you’ve considered the tidyverse but decided against it, why?

Any other discussion points of interest?

Discuss with your partner for a few minutes first, before sharing with the big group.

04:00

Time permitting

Let’s take a look at the source code for these slides for some of the highlighting tricks!

🔗 rstd.io/teach-ds-conf22 / Module 2