Teaching modern modeling with tidymodels

rstudio::conf(2022)

Designing the data science classroom

Maria Tackett

Session outline

- Teaching modern modeling

- Introducing tidymodels

- Teaching with tidymodels

- Feature engineering

- Prediction + model evaluation

- Train / test data

- Putting it all together

Teaching modern modeling

GAISE guidelines

- Teach statistical thinking.

- Teach statistics as an investigative process of problem-solving and decision-making.

- Give students experience with multivariable thinking.

- Integrate real data with a context and purpose.

- Use technology to explore concepts and analyze data.

See Guidelines for Assessment and Instruction in Statistics Education (GAISE) 2016 Report for full report.

Teaching modern regression

Facilitate opportunities for students to…

Regularly engage with real-world applications and complex data

Develop proficiency using professional statistical software and using a reproducible workflow

Identify appropriate methods based on the primary analysis objective - inference or prediction

Develop important non-technical skills, specifically written communication and teamwork

Introducing tidymodels

Tidymodels

Tidymodels

── Attaching packages ────────────────────────────────────── tidymodels 1.0.0 ──✔ broom 1.0.0 ✔ rsample 1.0.0

✔ dials 1.0.0 ✔ tune 1.0.0

✔ infer 1.0.2 ✔ workflows 1.0.0

✔ modeldata 1.0.0 ✔ workflowsets 1.0.0

✔ parsnip 1.0.0 ✔ yardstick 1.0.0

✔ recipes 1.0.1 ── Conflicts ───────────────────────────────────────── tidymodels_conflicts() ──

✖ scales::discard() masks purrr::discard()

✖ dplyr::filter() masks stats::filter()

✖ recipes::fixed() masks stringr::fixed()

✖ dplyr::lag() masks stats::lag()

✖ yardstick::spec() masks readr::spec()

✖ recipes::step() masks stats::step()

• Learn how to get started at https://www.tidymodels.org/start/Data: Loans from Lending Club

The data is the loans_full_schema data set from the openintro package and featured in the OpenIntro textbooks . It contains information about 50,000 loans made through the Lending Club platform. The variables we’ll use in this presentation are

interest_rate: Interest rate of the loan the applicant received.debt_to_income: Debt-to-income ratio.term: The number of months of the loan the applicant received.delinq_2y: Number of delinquencies on lines of credit in the last 2 years.

Data: Loans from Lending Club

Rows: 10,000

Columns: 55

$ emp_title <chr> "global config engineer ", "warehouse…

$ emp_length <dbl> 3, 10, 3, 1, 10, NA, 10, 10, 10, 3, 1…

$ state <fct> NJ, HI, WI, PA, CA, KY, MI, AZ, NV, I…

$ homeownership <fct> MORTGAGE, RENT, RENT, RENT, RENT, OWN…

$ annual_income <dbl> 90000, 40000, 40000, 30000, 35000, 34…

$ verified_income <fct> Verified, Not Verified, Source Verifi…

$ debt_to_income <dbl> 18.01, 5.04, 21.15, 10.16, 57.96, 6.4…

$ annual_income_joint <dbl> NA, NA, NA, NA, 57000, NA, 155000, NA…

$ verification_income_joint <fct> , , , , Verified, , Not Verified, , ,…

$ debt_to_income_joint <dbl> NA, NA, NA, NA, 37.66, NA, 13.12, NA,…

$ delinq_2y <int> 0, 0, 0, 0, 0, 1, 0, 1, 1, 0, 0, 0, 0…

$ months_since_last_delinq <int> 38, NA, 28, NA, NA, 3, NA, 19, 18, NA…

$ earliest_credit_line <dbl> 2001, 1996, 2006, 2007, 2008, 1990, 2…

$ inquiries_last_12m <int> 6, 1, 4, 0, 7, 6, 1, 1, 3, 0, 4, 4, 8…

$ total_credit_lines <int> 28, 30, 31, 4, 22, 32, 12, 30, 35, 9,…

$ open_credit_lines <int> 10, 14, 10, 4, 16, 12, 10, 15, 21, 6,…

$ total_credit_limit <int> 70795, 28800, 24193, 25400, 69839, 42…

$ total_credit_utilized <int> 38767, 4321, 16000, 4997, 52722, 3898…

$ num_collections_last_12m <int> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ num_historical_failed_to_pay <int> 0, 1, 0, 1, 0, 0, 0, 0, 0, 0, 1, 0, 0…

$ months_since_90d_late <int> 38, NA, 28, NA, NA, 60, NA, 71, 18, N…

$ current_accounts_delinq <int> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ total_collection_amount_ever <int> 1250, 0, 432, 0, 0, 0, 0, 0, 0, 0, 0,…

$ current_installment_accounts <int> 2, 0, 1, 1, 1, 0, 2, 2, 6, 1, 2, 1, 2…

$ accounts_opened_24m <int> 5, 11, 13, 1, 6, 2, 1, 4, 10, 5, 6, 7…

$ months_since_last_credit_inquiry <int> 5, 8, 7, 15, 4, 5, 9, 7, 4, 17, 3, 4,…

$ num_satisfactory_accounts <int> 10, 14, 10, 4, 16, 12, 10, 15, 21, 6,…

$ num_accounts_120d_past_due <int> 0, 0, 0, 0, 0, 0, 0, NA, 0, 0, 0, 0, …

$ num_accounts_30d_past_due <int> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ num_active_debit_accounts <int> 2, 3, 3, 2, 10, 1, 3, 5, 11, 3, 2, 2,…

$ total_debit_limit <int> 11100, 16500, 4300, 19400, 32700, 272…

$ num_total_cc_accounts <int> 14, 24, 14, 3, 20, 27, 8, 16, 19, 7, …

$ num_open_cc_accounts <int> 8, 14, 8, 3, 15, 12, 7, 12, 14, 5, 8,…

$ num_cc_carrying_balance <int> 6, 4, 6, 2, 13, 5, 6, 10, 14, 3, 5, 3…

$ num_mort_accounts <int> 1, 0, 0, 0, 0, 3, 2, 7, 2, 0, 2, 3, 3…

$ account_never_delinq_percent <dbl> 92.9, 100.0, 93.5, 100.0, 100.0, 78.1…

$ tax_liens <int> 0, 0, 0, 1, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ public_record_bankrupt <int> 0, 1, 0, 0, 0, 0, 0, 0, 0, 0, 1, 0, 0…

$ loan_purpose <fct> moving, debt_consolidation, other, de…

$ application_type <fct> individual, individual, individual, i…

$ loan_amount <int> 28000, 5000, 2000, 21600, 23000, 5000…

$ term <dbl> 60, 36, 36, 36, 36, 36, 60, 60, 36, 3…

$ interest_rate <dbl> 14.07, 12.61, 17.09, 6.72, 14.07, 6.7…

$ installment <dbl> 652.53, 167.54, 71.40, 664.19, 786.87…

$ grade <fct> C, C, D, A, C, A, C, B, C, A, C, B, C…

$ sub_grade <fct> C3, C1, D1, A3, C3, A3, C2, B5, C2, A…

$ issue_month <fct> Mar-2018, Feb-2018, Feb-2018, Jan-201…

$ loan_status <fct> Current, Current, Current, Current, C…

$ initial_listing_status <fct> whole, whole, fractional, whole, whol…

$ disbursement_method <fct> Cash, Cash, Cash, Cash, Cash, Cash, C…

$ balance <dbl> 27015.86, 4651.37, 1824.63, 18853.26,…

$ paid_total <dbl> 1999.330, 499.120, 281.800, 3312.890,…

$ paid_principal <dbl> 984.14, 348.63, 175.37, 2746.74, 1569…

$ paid_interest <dbl> 1015.19, 150.49, 106.43, 566.15, 754.…

$ paid_late_fees <dbl> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…Exploratory data analysis

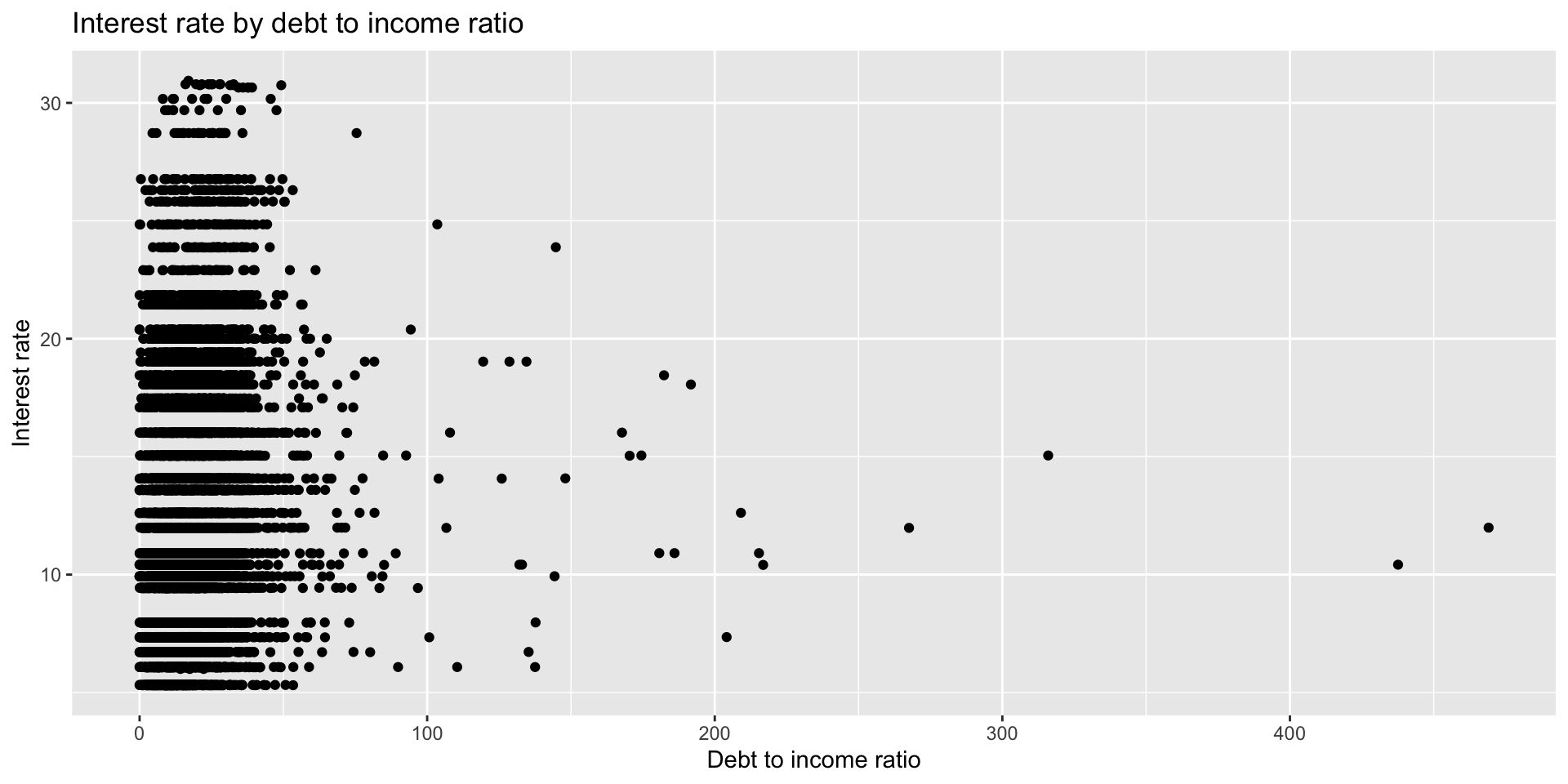

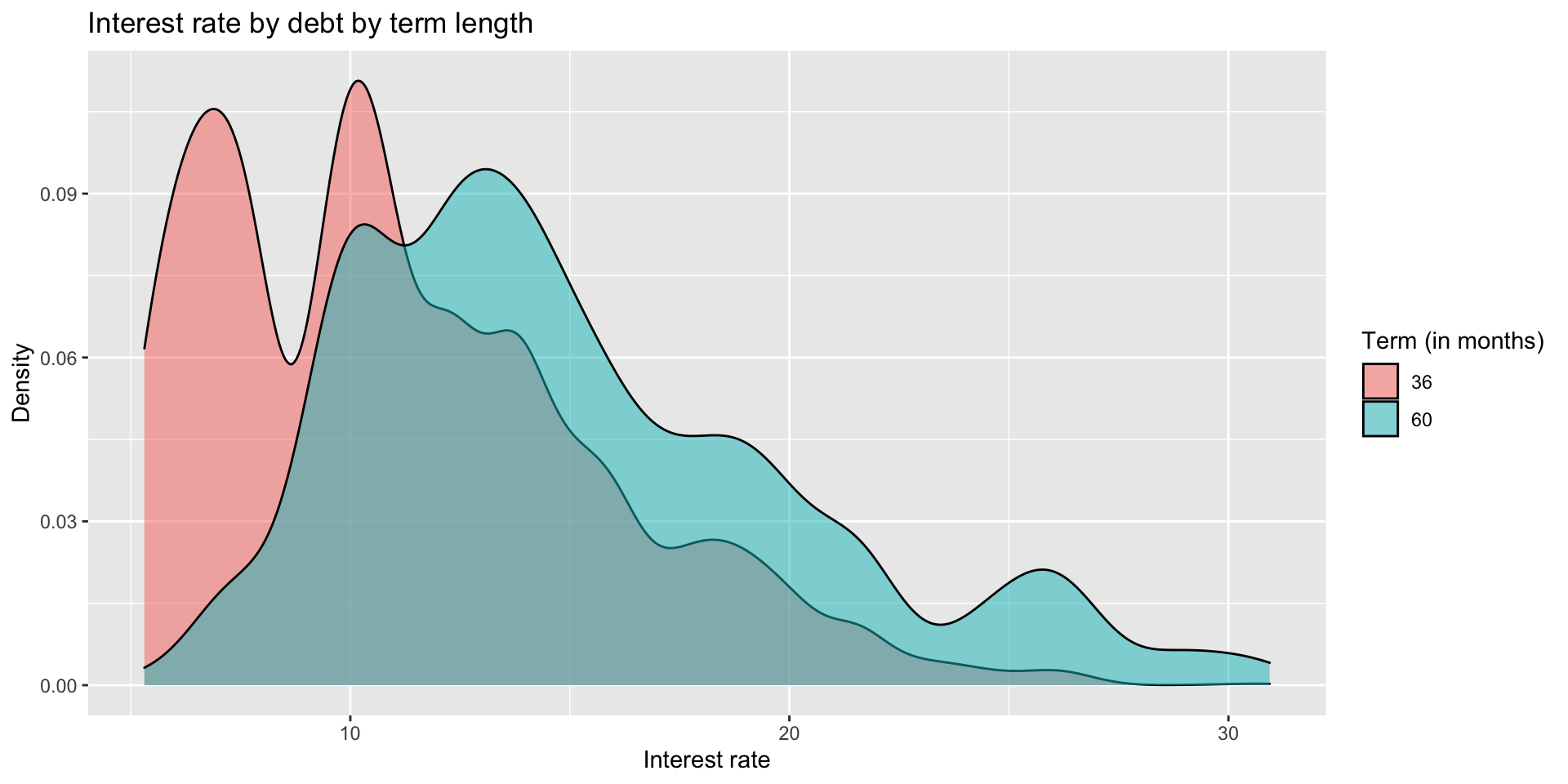

Exploratory data analysis

Exploratory data analysis

Regression syntax

Fit a linear regression model to predict the interest rate using the debt to income ratio.

Call:

lm(formula = interest_rate ~ debt_to_income, data = loans_full_schema)

Residuals:

Min 1Q Median 3Q Max

-21.7391 -3.7203 -0.7945 2.7351 18.6274

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 11.511445 0.080732 142.59 <2e-16 ***

debt_to_income 0.047183 0.003302 14.29 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 4.948 on 9974 degrees of freedom

(24 observations deleted due to missingness)

Multiple R-squared: 0.02007, Adjusted R-squared: 0.01997

F-statistic: 204.2 on 1 and 9974 DF, p-value: < 2.2e-16Model summaries using broom

Can utilize functions from the broom package to produce tidy summaries of models fit using Base R or the tidymodels framework

tidy(): summarizes information about model componentsglance(): reports information about the entire modelaugment(): adds information about observations to a data set

tidy()

glance()

# A tibble: 1 × 12

r.squared adj.r.s…¹ sigma stati…² p.value df logLik AIC BIC devia…³

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 0.0201 0.0200 4.95 204. 7.05e-46 1 -30105. 60217. 60238. 244166.

# … with 2 more variables: df.residual <int>, nobs <int>, and abbreviated

# variable names ¹adj.r.squared, ²statistic, ³deviance

# ℹ Use `colnames()` to see all variable names# A tibble: 1 × 12

r.squared adj.r.s…¹ sigma stati…² p.value df logLik AIC BIC devia…³

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 0.0201 0.0200 4.95 204. 7.05e-46 1 -30105. 60217. 60238. 244166.

# … with 2 more variables: df.residual <int>, nobs <int>, and abbreviated

# variable names ¹adj.r.squared, ²statistic, ³deviance

# ℹ Use `colnames()` to see all variable namesaugment()

# A tibble: 9,976 × 9

.rownames interest_rate debt_…¹ .fitted .resid .hat .sigma .cooksd .std.…²

<chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 1 14.1 18.0 12.4 1.71 1.01e-4 4.95 6.02e-6 0.345

2 2 12.6 5.04 11.7 0.861 1.91e-4 4.95 2.89e-6 0.174

3 3 17.1 21.2 12.5 4.58 1.02e-4 4.95 4.36e-5 0.926

4 4 6.72 10.2 12.0 -5.27 1.38e-4 4.95 7.80e-5 -1.07

5 5 14.1 58.0 14.2 -0.176 7.65e-4 4.95 4.86e-7 -0.0356

6 6 6.72 6.46 11.8 -5.10 1.74e-4 4.95 9.22e-5 -1.03

7 7 13.6 23.7 12.6 0.962 1.09e-4 4.95 2.06e-6 0.194

8 8 12.0 16.2 12.3 -0.285 1.05e-4 4.95 1.74e-7 -0.0577

9 9 13.6 36.5 13.2 0.357 2.32e-4 4.95 6.04e-7 0.0722

10 10 6.71 18.9 12.4 -5.69 1.00e-4 4.95 6.64e-5 -1.15

# … with 9,966 more rows, and abbreviated variable names ¹debt_to_income,

# ².std.resid

# ℹ Use `print(n = ...)` to see more rows# A tibble: 9,976 × 9

.rownames interest_rate debt_…¹ .fitted .resid .hat .sigma .cooksd .std.…²

<chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 1 14.1 18.0 12.4 1.71 1.01e-4 4.95 6.02e-6 0.345

2 2 12.6 5.04 11.7 0.861 1.91e-4 4.95 2.89e-6 0.174

3 3 17.1 21.2 12.5 4.58 1.02e-4 4.95 4.36e-5 0.926

4 4 6.72 10.2 12.0 -5.27 1.38e-4 4.95 7.80e-5 -1.07

5 5 14.1 58.0 14.2 -0.176 7.65e-4 4.95 4.86e-7 -0.0356

6 6 6.72 6.46 11.8 -5.10 1.74e-4 4.95 9.22e-5 -1.03

7 7 13.6 23.7 12.6 0.962 1.09e-4 4.95 2.06e-6 0.194

8 8 12.0 16.2 12.3 -0.285 1.05e-4 4.95 1.74e-7 -0.0577

9 9 13.6 36.5 13.2 0.357 2.32e-4 4.95 6.04e-7 0.0722

10 10 6.71 18.9 12.4 -5.69 1.00e-4 4.95 6.64e-5 -1.15

# … with 9,966 more rows, and abbreviated variable names ¹debt_to_income,

# ².std.resid

# ℹ Use `print(n = ...)` to see more rowsWhy Tidymodels?

There are advantages for more advanced modeling:

- Consistent syntax for different model types (linear, logistic, random forest, Bayesian, etc.)

- Streamline modeling workflow

- Split data into train and test sets

- Transform and create new variables

- Assess model performance

- Use model for prediction and inference

Teaching with tidymodels

Tidymodels syntax

linear_reg() |>

set_engine("lm") |>

fit(interest_rate ~ debt_to_income, data = loans_full_schema) |>

tidy()# A tibble: 2 × 5

term estimate std.error statistic p.value

<chr> <dbl> <dbl> <dbl> <dbl>

1 (Intercept) 11.5 0.0807 143. 0

2 debt_to_income 0.0472 0.00330 14.3 7.05e-46Let’s break down the syntax.

1️⃣ Specify model

2️⃣ Set computational engine

3️⃣ Fit the model

4️⃣ Summarize output

Consistent syntax for other models

The syntax is the same if we fit a more advanced model, such as a logistic regression model.

Fit a model to predict the loan term length (36 or 60 months) based on the loan amount.

Feature engineering

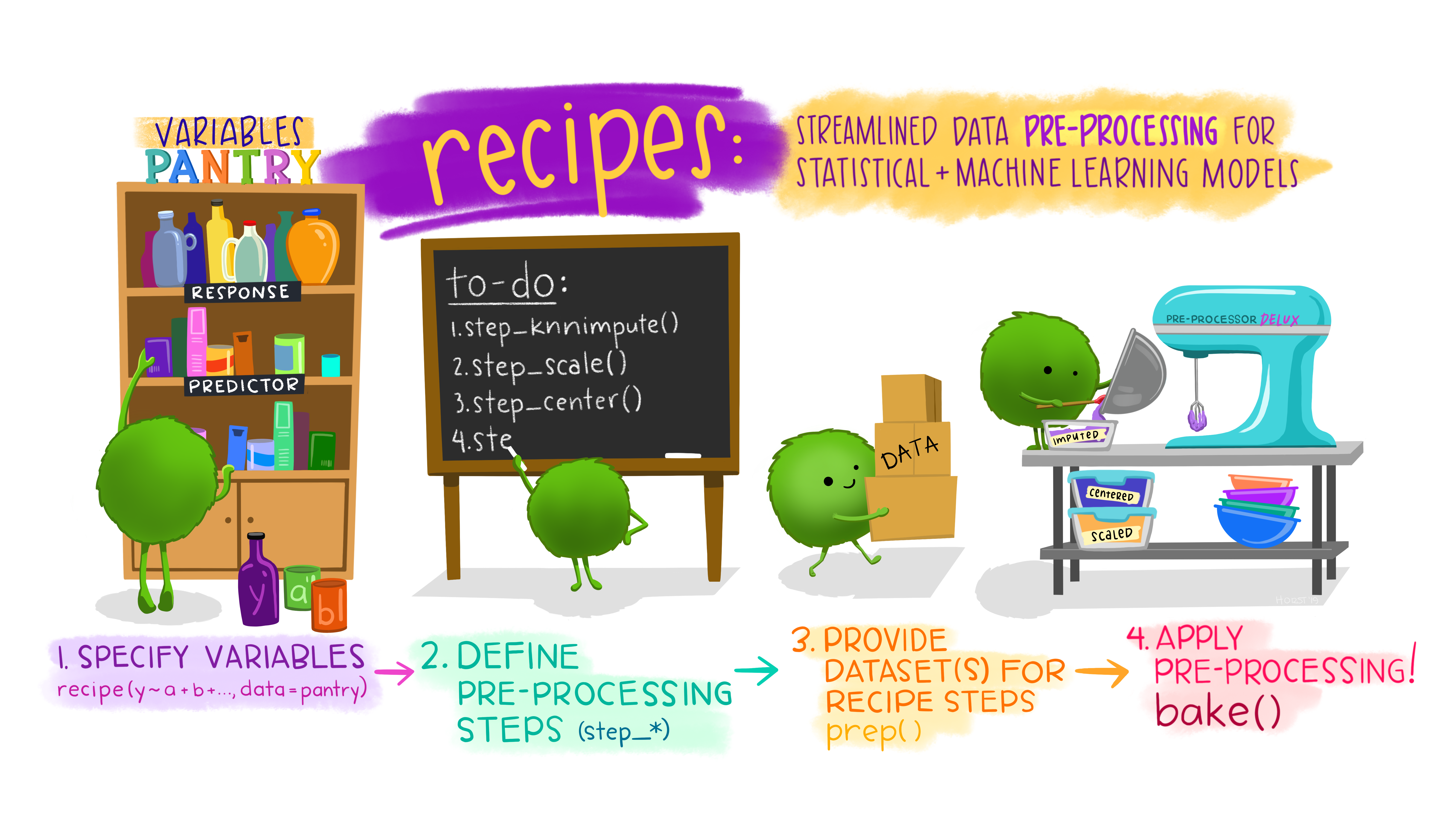

Feature engineering is the process of transforming raw variables in preparation for use in a statistical model.

You may be familiar doing feature engineering using dplyr before fitting the model.

The recipes package makes it possible to do feature engineering as part of the modeling workflow using “dplyr-like” functions.

Example: Predicting interest rate

Goal: Fit a model to predict the interest rate based on the term, debt to income ratio, and number of delinquencies in the past two years.

We need to do the following to prepare the predictors for the model:

Make

terma factor.Mean-center

debt_to_income.Split

delinq_2yinto the categories 0, 1, 2, 3+.

Feature engineering using dplyr

# Feature engineering

loans_full_schema <- loans_full_schema |>

mutate(term_fct = as_factor(term)) |>

mutate(debt_to_income_cent =

debt_to_income - mean(debt_to_income, na.rm = TRUE)) |>

mutate(delinq_2y_cat =

cut(delinq_2y, breaks = c(-Inf,0,1, 2, 3, Inf)))

# Fit the model

lm(interest_rate ~ term_fct + debt_to_income_cent + delinq_2y_cat,

data = loans_full_schema) |>

tidy()# A tibble: 7 × 5

term estimate std.error statistic p.value

<chr> <dbl> <dbl> <dbl> <dbl>

1 (Intercept) 11.0 0.0584 189. 0

2 term_fct60 3.86 0.100 38.5 6.67e-303

3 debt_to_income_cent 0.0429 0.00307 14.0 5.47e- 44

4 delinq_2y_cat(0,1] 1.37 0.153 8.95 4.08e- 19

5 delinq_2y_cat(1,2] 1.68 0.291 5.76 8.57e- 9

6 delinq_2y_cat(2,3] 2.46 0.492 5.00 5.78e- 7

7 delinq_2y_cat(3, Inf] 2.85 0.563 5.05 4.39e- 7Discussion

What is a disadvantage to this approach?

02:00

Feature engineering with recipes

Illustration by Allison Horst

Specify the variables

Define pre-processing steps

Make term a factor.

Define pre-processing steps

Mean-center debt_to_income.

Define pre-processing steps

Break delinq_2y into the categories 0, 1, 2, 3+.

Putting it all together

Putting it all together

Prep and bake to see created variables

Exercise 1: Feature engineering

RStudio Cloud > “Model 3 - Tidymodels” > ex-3-1.qmd

Write the recipe for the model in the exercise file. Call the recipe loans_rec. Use the appropriate step_* functions to complete the feature engineering steps shown in the dplyr pipeline.

You can find the list of step_* functions on the recipes reference page.

Compare your answer with your neighbor along with what you found easy/straightforward and what you found challenging about writing the recipe. Then, type one recipe and one takeaway from your discussion.

15:00

Fit the model using workflow()

Workflows bring together models and recipes, making them easier to apply to multiple data sets, e.g, training and test data.

View workflow

══ Workflow ════════════════════════════════════════════════════════════════════

Preprocessor: Recipe

Model: linear_reg()

── Preprocessor ────────────────────────────────────────────────────────────────

3 Recipe Steps

• step_mutate()

• step_center()

• step_cut()

── Model ───────────────────────────────────────────────────────────────────────

Linear Regression Model Specification (regression)

Computational engine: lm Fit model to data

# A tibble: 7 × 5

term estimate std.error statistic p.value

<chr> <dbl> <dbl> <dbl> <dbl>

1 (Intercept) 11.0 0.0584 189. 0

2 term60 3.86 0.100 38.5 6.67e-303

3 debt_to_income 0.0429 0.00307 14.0 5.47e- 44

4 delinq_2y(0,1] 1.37 0.153 8.95 4.08e- 19

5 delinq_2y(1,2] 1.68 0.291 5.76 8.57e- 9

6 delinq_2y(2,3] 2.46 0.492 5.00 5.78e- 7

7 delinq_2y(3, Inf] 2.85 0.563 5.05 4.39e- 7Prediction + Model evaluation

Make predictions

interest_pred <- predict(interest_fit, loans_full_schema) |>

bind_cols(loans_full_schema |> select(interest_rate))

interest_pred# A tibble: 10,000 × 2

.pred interest_rate

<dbl> <dbl>

1 14.8 14.1

2 10.4 12.6

3 11.1 17.1

4 10.6 6.72

5 12.7 14.1

6 11.8 6.72

7 15.1 13.6

8 16.1 12.0

9 13.1 13.6

10 11.0 6.71

# … with 9,990 more rows

# ℹ Use `print(n = ...)` to see more rowsModel evaluation: \(R^2\)

\(R^2\) is the percent of variability in the interest rate explained by the model.

Model evaluation: \(RMSE\)

\(RMSE\) is a measure of the error in the model predictions.

\[ RMSE = \sqrt{\frac{\sum_{i=1}^{n}(\hat{y}_i - y_i)^2}{n}} \]

Exercise 2: Fit, predict, evaluate

RStudio Cloud > “Model 3 - Tidymodels” > ex-3-2.qmd

Build a workflow and fit the model specified in the exercise. Then calculate predictions and evaluate the model using \(R^2\) and \(RMSE\).

Compare your answer with your neighbor. Type any questions that come up during the exercise and discussion.

10:00

What is a limitation to the model evaluation we’ve done thus far?

Splitting the data

Splitting the data into training and testing sets allows us to evaluate the model on new data.

Split the data.

Fit the model to the training data

We can fit the model specified in interest_workflow (model spec + recipe) to the training data.

# A tibble: 7 × 5

term estimate std.error statistic p.value

<chr> <dbl> <dbl> <dbl> <dbl>

1 (Intercept) 11.0 0.0646 170. 0

2 term60 3.91 0.112 35.1 1.05e-250

3 debt_to_income 0.0402 0.00331 12.2 1.12e- 33

4 delinq_2y(0,1] 1.33 0.171 7.79 7.77e- 15

5 delinq_2y(1,2] 1.75 0.323 5.41 6.38e- 8

6 delinq_2y(2,3] 2.48 0.536 4.63 3.79e- 6

7 delinq_2y(3, Inf] 3.01 0.617 4.88 1.09e- 6Evaluate performance on training data

Calculate predictions

Evaluate model

# A tibble: 1 × 3

.metric .estimator .estimate

<chr> <chr> <dbl>

1 rsq standard 0.161Evaluate performance on testing data

Calculate predictions

Evaluate model

# A tibble: 1 × 3

.metric .estimator .estimate

<chr> <chr> <dbl>

1 rsq standard 0.140Exercise 3: Train / test data (time permitting)

RStudio Cloud > “Model 3 - Tidymodels” > ex-3-3.qmd

Complete the code below to split the data into training (80%) and testing (20%) sets. Fit the model to the training set, then evaluate the model on the training and test sets.

Discuss the model performance with your neighbor. Then, type your group’s assessment of the model performance.

10:00

Putting it all together

Let’s take a look at a full analysis.

RStudio Cloud > “Model 3 - Tidymodels” > ex-3-full-analysis.qmd

Discussion

Discuss the following with your neighbor.

What is something from this module you can implement in your data science course?

Do you anticipate any challenges / is there anything that makes you hesitant about teaching modeling using tidymodels?

Any other discussion points of interest?

Discuss with your partner for a few minutes first, before sharing with the big group.

04:00

🔗 rstd.io/teach-ds-conf22 / Module 3